Sản phẩm nổi bật

Phòng Kinh Doanh

Phòng Kinh Doanh

-

Ms Nhâm

Ms Nhâm -

02512 619 986 - 0251.2604.987

02512 619 986 - 0251.2604.987 -

Ms. Sang

Ms. Sang -

02512 604 988

02512 604 988

VIDEO

VIDEO

Tư vấn online

Tư vấn online

0084983221848

0084983221848 (+84) 983221848

(+84) 983221848 (+84) 983221848

(+84) 983221848 truonghung2006 - thanhdanhco.ltd

truonghung2006 - thanhdanhco.ltd hungvn1848

hungvn1848

SẢN PHẨM MỚI

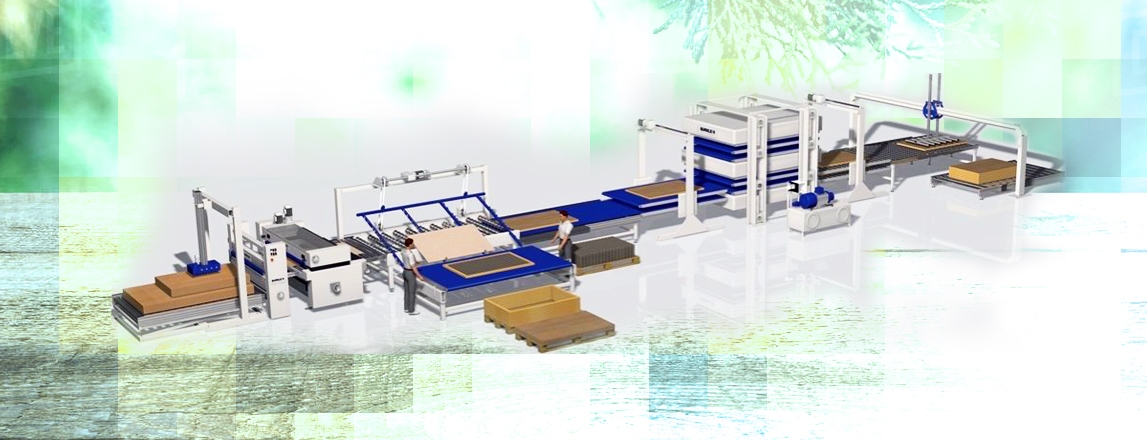

Dây chuyền máy ghép thanh công nghệ mới – 7500mm

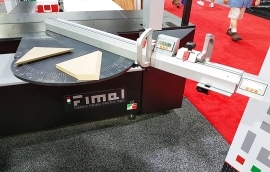

MÁY BÀO 4 MẶT – CÔNG NGHỆ MỚI CÓ BĂNG TẢI ĐẦU VÀO VÀ BĂNG TẢI THU HỒI PHÔI

Tin tức nổi bật

-

Dự án viên nén Wood Pellet tại Việt Nam

TỔNG QUAN NHÀ MÁY Nguyên liệu TỔNG QUAN NHÀ MÁY TỦ ĐIỆN DÂY CHUYỀN TỦ ĐIỆN DÂY CHUYỀN

-

Triển lãm VIETNAMWOOD 2017 – Triển lãm Q/tế lần thứ 12 về máy móc, thiết bị

Triển lãm Vietnamwood 2017 – triển lãm quốc tế lần thứ 12 về máy móc, thiết bị chuyên ngành chế biến gỗ diễn ra từ ngày 18 đến 21 tháng 10 năm 2017 Tại Trung tâm Hội nghị và Triển lãm Sài Gòn (SECC) VietnamWood 2017 bao gồm hơn 320 nhà triển lãm từ 25 quốc gia và khu vực,…

-

Dự án dây chuyền máy thức ăn thủy sản công nghệ mới

Kỹ sư game đánh bài online đổi tiền mặt lắp đặt dây chuyền máy Tổng quan nhà máy Kỹ sư game đánh bài online đổi tiền mặt lắp đặt dây chuyền máy Tủ điện dây chuyền Tổng quan nhà máy Tổng quan nhà máy Kỹ sư game đánh bài online đổi tiền mặt lắp đặt dây chuyền máy Kỹ sư Salmatec lắp đặt và chuyển giao công nghệ máy

-

Nhà máy s/x MDF c/suất 80,000m3/năm tại game đánh bài online đổi tiền mặt Cty Long Hải Phát

DÂY CHUYỀN MÁY BĂM GỖ TRÒN – NHÀ MÁY LONG HẢI PHÁT

Phòng Kinh Doanh

Phòng Kinh Doanh

VIDEO

VIDEO